The Buy Now Pay Later scheme in UAE has leapt forward with the UAE Ministry of Finance (MoF) announcing a new partnership with Tabby.

What is a BNPL scheme?

The Ministry of Finance has announced a simple way to pay the fines. As per the scheme, now the UAE residents can pay federal government fees and fines in monthly installments for the first time in history. However, it is a move that supports digital transformation, enhances financial flexibility, and boosts customer satisfaction across federal government services.

On top of it, this development comes at a time when the UAE Buy Now Pay Later (BNPL) market is already seeing rapid growth due to fintech innovation, rising e-commerce activity, and expanded applications across new sectors.

Buy Now Pay Later scheme in UAE for federal fees and fines.

The Ministry of Finance confirmed that you can now settle the federal fees and fines using the Tabby BNPL model. Take a look at how this system works:

- Tabby pays the full amount upfront to the respective federal entity.

- Customers then repay Tabby in installments based on pre-agreed terms.

- A commission rate applies only to users who choose the installment option—and MoF says it secured the best possible rate.

- The service is available across all federal government entities.

The campaign has significantly expanded the electronic payment ecosystem of the UAE and supports financial inclusion by allowing you to manage your obligations more flexibly.

Boosting Digital Transformation in Government Payments

According to Saeed Rashid Al Yateem, Assistant Undersecretary for the Government Budget and Revenue Sector, the partnership shows the commitment of the Ministry to modernising payments. Moreover, he highlighted the following points:

- The BNPL model provides greater security and flexibility for residents.

- It improves overall financial collection efficiency across federal entities.

- It aligns with the UAE’s strategy to build a sustainable, integrated financial infrastructure.

Tabby’s CEO, Hosam Arab, said that the company is proud to support the MoF in making the government services more accessible and financially manageable for the UAE residents.

Why This Matters for UAE Residents

The launch of the Buy Now Pay Later Scheme in UAE has many benefits. You can enjoy the following advantages:

- Flexible Payment for Essential Services

Government fees and fines are often unavoidable expenses. Now, it can be spread more than in installments.

- Reduced financial pressure

Residents no longer need to pay large amounts upfront to make budgeting easier.

- Faster and Digital-First Payments

This campaign reduces dependence on traditional credit and aligns with the cashless payment vision of the UAE.

- Secure and Regulated System

The Buy Now Pay Later Scheme in UAE now operates under regulatory frameworks introduced by the UAE Central Bank in 2023 to ensure customer protection.

BNPL Market Growth in the UAE

The UAE is one of the fastest-growing BNPL markets globally. According to the Q3 2025 BNPL data book, the market is seeing the following increases:

- The market is set to reach US$2.84 billion in 2025, growing 15.6% annually.

- From 2025–2030, the BNPL market is projected to grow at a CAGR of 11.2%, reaching US$4.82 billion by 2030.

- The sector grew at a 24.5% CAGR between 2021–2024.

This growth aligns with increasing customer demand for instalment-based payment, especially among demographics and expats.

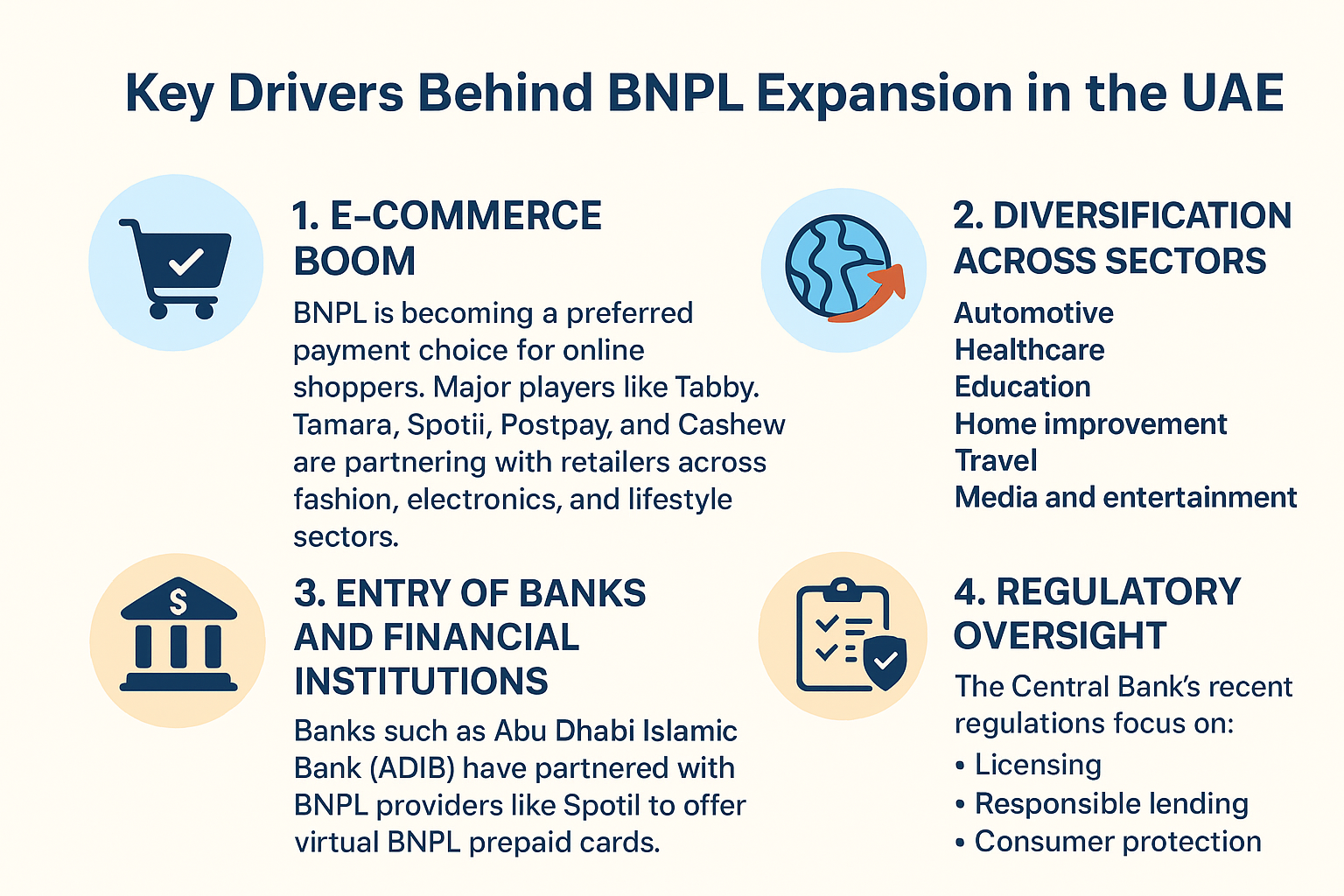

Key Drivers Behind BNPL Expansion in the UAE

- E-commerce Boom

BNPL is becoming the preferred choice for online shoppers. Plus, many players like Tabby, Tamara, Spotii, Postpay, and Cashew are partnering with retailers across fashion, electronics, and lifestyle sectors.

- Diversification Across Sectors

BNPL is expanding into different sectors, like automotive, healthcare, education, home improvement, travel, etc. For example, Spotli has already introduced the first BNPL service for car purchases through its partnership with Arabian Automobiles.

3. Entry of Banks and Financial Institutions

Banks like Abu Dhabi Islamic Bank (ADIB) have partnered with BNPL providers like Spotii to offer virtual BNPL prepaid cards. So, it has signalled growing interest from old financial institutions.

4. Regulatory Oversight

The recent regulation of the UAE Central Bank focuses on licensing, responsible lending, and consumer protection. So, this regulated environment increases trust and motivates broader adoption.

Who Are the Major BNPL Players in the UAE?

The UAE BNPL market is highly competitive due to local and international players. Below is the list of top players for the Buy Now Pay Later Scheme in UAE:

- Tabby—the leading BNPL provider—recently secured $700 million in financing.

- Tamara—Expanding rapidly across the UAE.

- Spotii – Partnered with ADIB for bank-integrated BNPL solutions.

- Postpay

- Cashew

- Aramex Smart

- Rise

- Payby

- Zoodpay

Global giants like Kiara are also entering the UAE. Hence, it has added to the competition in the UAE BNPL market.

What This Means for the Future of BNPL in the UAE

The following are the predictions about the UAE BNPL for more than the next 2 to 4 years:

- It might be more diverse, with customized offerings for various sectors.

- It may be more competitive, as banks join fintechs in the installment space.

- It may become more innovative due to new payment models and digital solutions.

- It is expected to be more regulated to support responsible and sustainable growth.

The BNPL is expected to continue to reshape customer spending habits. Hence, it would give residents more financial flexibility while motivating digital-first transactions.

Conclusion

The launch of the Buy Now Pay Later Scheme in UAE for the federal government is a big step. So, it will provide you with greater flexibility, convenience, and financial control because Tabby is now offering installment-based payments for the government fees and fines.

Plus, the Buy Now Pay Later scheme in UAE is set to become a core part of the digital payment ecosystem due to the combination of the UAE’s fast-growing BNPL market, regulatory advancements, and expansion into many industries.

Read more:

Banned Activities During UAE National Day: MOI Issues Safety Rules for the 54th Eid Al Etihad

Minimum Wage Rise in UK: What the 4.1% Increase Means for Workers in 2026

UAE National Day 2025: Best Events, Staycations & Things to Do Across the Emirates

[…] Buy Now Pay Later (BNPL) Scheme in UAE for Gov Fines and Fees: Discover How it Works […]

[…] Buy Now Pay Later (BNPL) Scheme in UAE for Gov Fines and Fees: Discover How it Works […]

[…] Buy Now Pay Later (BNPL) Scheme in UAE for Gov Fines and Fees: Discover How it Works […]