3 February 2026| Dubai, UAE [Posted at 2:47 pm]

Opendoor is back in the spotlight. A fresh CEO appointment, a sharper pivot toward artificial intelligence (AI), and mixed market signals are reshaping how investors view the online real estate platform. For UAE-based investors tracking US tech-driven property stocks, this moment could be more important than it looks.

Related Reads – UAE Citizenship for Companies: Everything You Need to Know About the New Law

Financial History in Dubai: Emirates NBD Launches the Region’s First Dh1 Billion Digital Bond

Nvidia Becomes World’s First $5 Trillion Company as AI Boom Drives Record-Breaking Rally

Leadership Shake-Up: Why It Matters

At the top of any company, leadership changes often signal deeper strategic shifts.

Opendoor Technologies (NasdaqGS: OPEN) has appointed a new chief executive officer, marking a clear reset at the leadership level.

This move comes at a time when the company is rethinking how it runs its capital-intensive home-buying model.

The new CEO is expected to push AI from a support tool to the backbone of the company’s operations. This matters because its success depends on pricing accuracy, inventory turnover, and risk control, areas where automation and data science can make or break margins.

AI at the Core of Opendoor’s Strategy

This is not an experimental shift; it targets the heart of the business.

The company plans to embed AI deeply into home valuation, pricing algorithms, and transaction workflows. Unlike cosmetic tech upgrades, this approach directly affects profitability and scalability.

Here’s what the AI-first approach aims to improve:

- Pricing accuracy: Better valuation models may reduce losses on resold homes.

- Operational efficiency: Automated workflows can lower processing time and costs.

- Risk management: Data-driven underwriting may limit exposure during housing downturns.

For investors, this raises a critical question: can it run its house-flipping model more like a software company than a traditional real estate operator?

Read more – Trump’s Trap or Modi’s Masterstroke? Decoding the Terrifying Trade-off Involving Russia and China

Influencer Marketing: A Comprehensive Guide to its Benefits, Risks, and Global Trends

How Opendoor Compares With Zillow and Redfin

Competition provides context for whether this strategy can work.

Opendoor operates in the same ecosystem as Zillow and Redfin, but with a heavier balance sheet due to direct home ownership. The CEO change and AI push suggest a renewed attempt to tighten spreads and reduce holding risk—two long-standing investor concerns.

In simple terms, if AI helps it buy smarter and sell faster, it could narrow the gap with leaner competitors.

Stock Technicals: Is Opendoor Oversold?

Market indicators are flashing cautious optimism.

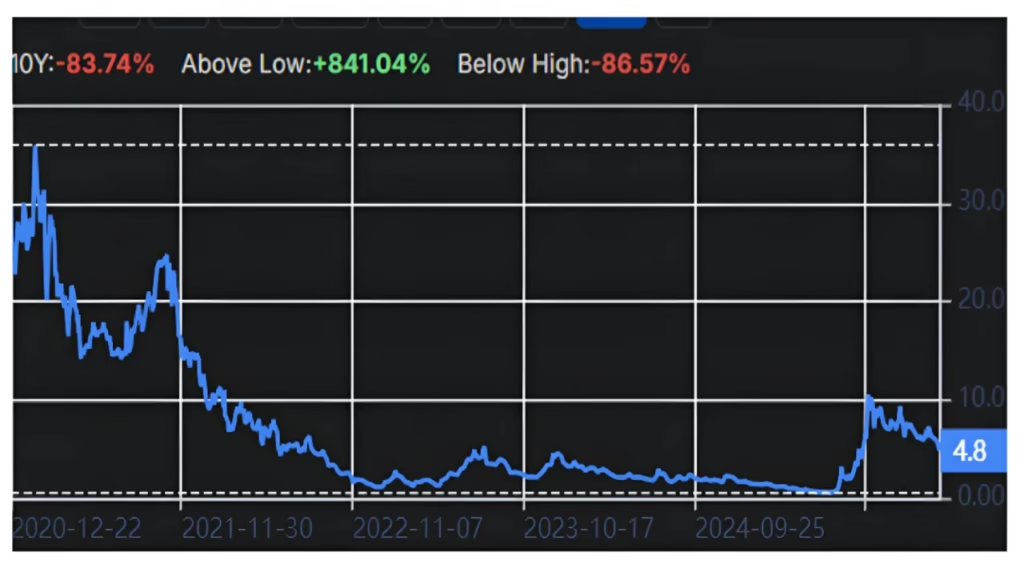

Recently, Opendoor’s Relative Strength Index (RSI) dipped to 29.8, placing the stock in oversold territory. For context, an RSI below 30 often suggests that selling pressure may be nearing exhaustion.

Key technical highlights to know:

- 52-week range: $0.492 (low) to $10.52 (high)

- Recent trading range: Around $4.80–$5.05

- RSI-14: Near oversold levels

For contrarian investors, this may signal a potential entry point—though not without risk.

Options Activity and Market Sentiment

Derivatives markets often reveal investor psychology before price moves.

Options activity around it has been relatively subdued. The put/call ratio sits near 0.28, showing more interest in call options than puts, while implied volatility has dropped into the lower quartile of its yearly range.

In short:

- Traders expect lower short-term price swings

- Some demand for downside protection remains

- Earnings could act as a volatility trigger

Financial Health: Strengths and Warning Signs

Numbers tell a balanced—but tense—story.

The company reported trailing twelve-month revenue of $4.7 billion, but profitability remains elusive. The company runs with high leverage, a known risk in fluctuating housing markets.

Important financial signals include:

- Operating margin: -4.32%

- Debt-to-equity: 2.2

- Current ratio: 2.83 (healthy liquidity)

- Altman Z-Score: 1.93 (grey zone for financial stress)

For UAE investors used to asset-heavy businesses, this underscores why execution discipline is critical.

Risks and Rewards Investors Are Weighing

This is a high-risk, high-reward setup.

Before making any decision, investors are balancing clear trade-offs.

Key risks includes:

- AI tools may fail to meaningfully improve margins

- Workforce automation could hurt local pricing expertise

- Housing and interest rate cycles remain unpredictable

Potential rewards include:

- Leaner operations through AI-driven workflows

- Improved risk controls and faster inventory turns

- Clearer performance targets under new leadership

FAQs

1. Is Opendoor profitable yet?

No, it is still operating at a loss, though it maintains solid liquidity.

2. Why is AI important for Opendoor?

AI can improve pricing accuracy, reduce risk, and potentially increase margins in a low-margin business.

3. Is Opendoor stock oversold?

Recent RSI readings suggest the stock has entered oversold territory, which some investors view as a potential opportunity.

4.What should investors watch next?

Upcoming earnings, AI execution updates, and housing market trends will be key catalysts.

Conclusion

Opendoor’s new CEO and AI-first strategy represent more than a cosmetic shift—they strike at the core of its business model. While financial stress and volatility remain real concerns, oversold technicals and a renewed strategic focus could reshape investor sentiment.

Read more – Why Fujairah Is the UAE’s Most Underrated Emirate

[…] Opendoor Appoints New CEO, Doubles Down on AI as Stock Nears Oversold Zone: What Investors in the UA… […]