The global cryptocurrency market is currently seeing heightened instability as concerns over the US regional banking sector and broader credit market stress ripple across the risk-driven assets. Hence, the world’s largest cryptocurrency, Bitcoin, has fallen below the $108,000 (Dh396,630) mark. Therefore, it has triggered liquidation in the Bitcoin perpetual futures market totaling $147 million as per the Coin Glass data.

Bitcoin Faces Key Support Levels Amid Market Uncertainty

After the flash clash of last week, the currency has struggled to regain its momentum. Hence, the digital asset has recorded a 1.9% decline to $108,830.2 by early Friday (ET), which marks the second consecutive week of losses. However, it dropped 10 percent amid escalating US-China trade tensions and increased credit risk fear in the last week. Now, experts closely monitor the $100,000 level as the potential support zone.

Simon Peters, Crypto Analyst at eToro, said, “If concerns in the US banking sector remain isolated and do not accelerate into systemic risks, we could see the bounce as investors take the opportunity to buy during the dip. An end to the government shutdown and favorable US economic data could also provide a short-term tailwind to prices.”

During the recent turbulence, the cryptocurrency market is still attracting investor attention in the United Arab Emirates (UAE), where risk-tolerant traders are assessing opportunities and challenges in the shifting macroeconomic environment.

Ripple’s XRP Initiative Amid Market Downturn

Despite falling crypto prices, Ripple Labs is taking a smart move to strengthen the position of XRP. Bloomberg reported that Ripple is leading efforts to raise $1 billion in funding to develop a strategic token stockpile using a special acquisition vehicle and contributing some of its XRP.

On the other hand, XRP showed a limited positive response to the news, as it also fell by 3.7 percent to $2.3385. Moreover, the token is near an 11-month low after the flash crash of the market. Now, XRP has recorded a 19.8 percent slump over the past two weeks. Hence, it highlights the widespread impact of risk aversion in the global market.

Broader Crypto Market Declines

Other cryptocurrencies also followed the downward trend of Bitcoin. Hence, Ethereum (Ether) fell 3.7% to $3,889.0, and Binance Coin (BNB) dropped 5.2% to $1,127. Moreover, Altcoins such as Cardano and Solana recorded declines exceeding 5%. Therefore, it shows the spillover effects from the recent cryptocurrency struggles.

Meme coins also faced losses. Similarly, Dogecoin is declining 5.7% and $TRUMP is falling 3.7%. Despite these drops, prices remained above the lows of the last week. Hence, it suggests potential stabilization if the macroeconomic concerns ease.

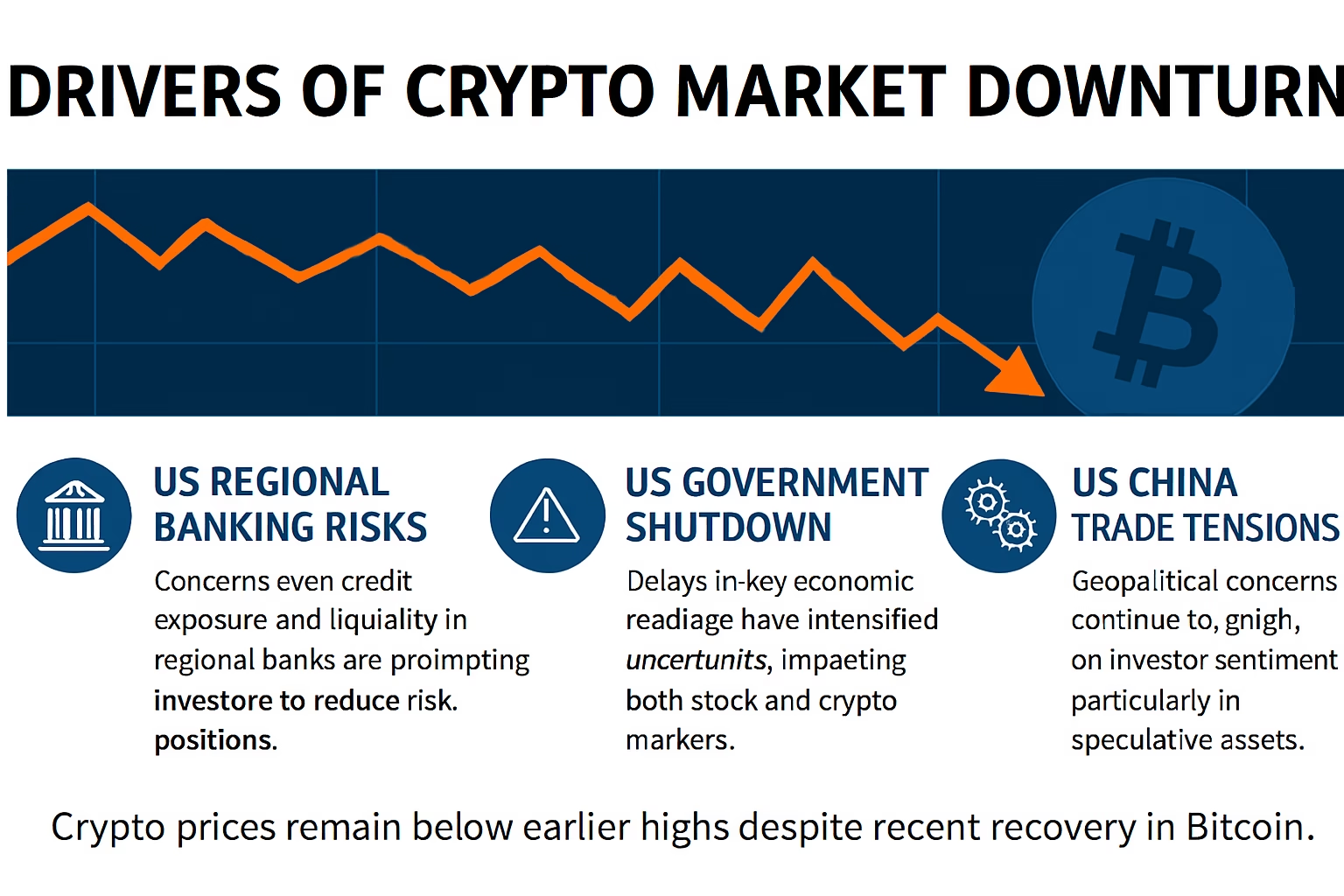

Factors Driving Volatility

Market experts cite many factors for attracting the current crypto markets. However, the following are the key contributors:

- US Regional Banking Risks: Growing concerns over credit exposure and liquidity in regional banks are prompting investors to reduce risk positions.

- US Government Shutdown: Delays in key economic readings have intensified uncertainty, which influences the stock and crypto markets.

- US-China Trade Tensions: Geopolitical concerns continue to weigh on investor sentiment, particularly in speculative assets.

Bitcoin did recover some losses this week on peaceful signals from the Federal Reserve. Plus, the broader crypto market is cautious. Plus, prices are still well below early-October highs. However, this cryptocurrency previously traded above $126,000.

Outlook for UAE Crypto Investors

Careful risk management and strategic decision-making are needed to handle this turbulent market. However, analysts recommend monitoring critical support levels like $100,000 and seeing development in regional banking and the US economic policies.

Simon Peters added that any resolution to the government shutdown or positive US economic data could give temporary relief. However, it is important to stay alert, as broader macroeconomic uncertainty could prolong the corruption phase.

Read more:

Dude Movie Review: Pradeep Ranganathan Delivers an Engaging Yet Romantic Drama 2025

Expo City Dubai Hosts Goat Festival at Terra This October and November 2025

[…] Bitcoin Dips Below $108,000 Amid Global Risk Concerns […]